About Us

By means of Introduction, we are pleased to mention that experience of over 30 years in the Investment and insurance agency.

The know-how and proficiency in most of the financial products and asset classes, having worked over 40 Years with Individual Familys, building their assets and protecting their securities, has made us capable to be your “Investment and Insurance Agent” And that is also the foundation of our entrepreneur “DhanSaathi” with the motive to plan your future.Being your “Investment and Insurance Agent”.

This is our duty to answer all your financial queries because in your daily life you have to take many financial decisions or deal with confusions related to your savings, your taxes, your liabilities & assets, so we constantly try to justify the role of financial advisor.

- You can have talk with us through any media on different relatable topic like Financial Investment Planning, Insurance Planning,Tax Planning, Real Estate, Mutual Fund, Retirement Planning, FDs, Postal Small Savings and many more.

- Why You Should Consider Us "Product advising & Product Servicing is a hobby" Hardworking, Committed, Dependable, Friendly and Knowledgeable Professional.

- Collectively, Currently manage over 790Cr AUA for more than 16000 individual clients. We specialize in provideing Investment and Insurance for individuals. We have been managing clients Investment and Insurance since 1980. Our clients consist of self-employed individuals, small local businesses, non-profit organizations, foundations, Trusts, school districts with digitally connected throughout the Country.

Services

Investment And Insurance Shop Since 1980

Mutual Funds

When you buy a mutual fund, your money is combined with the money from other investors, and allows you to buy part of a pool of investments.

General Insurance

Your Car, Travel, Home, Office, Health & Bike Insurance. Get an Instant quote Now. Customized Quote in 2 min. Issue Policy Online in 2 min. Get Tax Benefits.

Life Insurance

Is important, as it protects your family and lets you leave them a non-taxable amount at the time of death. Issue Policy Online in 5 min. Get Tax Benefits.

Company Fixed Deposits

Company Fixed Deposit (corporate FD) is a term deposit which is held over fixed period at fixed rates of interest. Company Fixed Deposits are offered by Financial and Non-Banking financial companies (NBFCs).

Postal Small Savings

Post Office investments Small savings schemes to consider for safe and guaranteed returns. India Post or Department of Posts, which runs postal services in the country, offers nine types of small saving schemes.

Govt Bonds

A government bond is a debt instrument issued by the Central and State Governments of India. Issuance of such bonds occur when the issuing body (Central or State governments) faces a liquidity crisis and requires funds for the purpose of infrastructure development.

Why choose us?

Product Advising & Product Servicing is a Hobby

Hardworking, Committed, Dependable, Friendly and Knowledgeable Professional.

Collectively, Currently manage over 790Cr AUA for more than 16000 individual clients. We specialize in developing and maintaining long term Investment and Insurance for individuals. We have been managing clients Investment and Insurance since 1980. Our clients consist of self-employed individuals, small local businesses, non-profit organizations, foundations, Trusts, school districts with digitally connected throughout the Country.

Our Vision

Our Vision Our mission as an independent financial caretaker is to deliver objective and honest opinion to our clients and serve as their Family Wealth Guardians. As a financial caretaker, we foster interaction and engagement with all of our client family members who seek to secure their wealth for generations. We strive to be recognized by our clients, employee and the communities we serve as a best-in-class as an independent financial caretaker.

Clients

Transaction

Hours Of Support

Hard Workers

Call To Action

Your Invesment And Insurance at your finger tips lets Connect

Investing And Insuring is a good idea or not

As the debate of whether investing and insuring is a good idea or not continues till date, you can surely come to the conclusion that there are more reasons why you should do it instead of not investing if only you look around a bit. Investing in Mutual Funds, Fixed Deposits, Bonds can result in being one of the best and most important financial decisions that you can make. We will list out the top ten reasons why you should invest and then you judge for yourself whether investing in it will be a good option or not..

Insurance comes down to the fact that it is a step taken to protect, care and safeguard for the future. Insurance as mentioned earlier is a highly debatable topic but most of the points against it are based purely on misconceptions. In the following list, we will enlist every important and convincing reason as to why insurance is an essential step and clear out any misconception in the process.

The Top Ten Reasons for investing and insuring

Security and Assurance

The Debt Issue

Retirement plans

Long Term Plans and Dreams

No Business Worries

For Tax Saving

Begin As Early As Possible

Helps to Buy various Options

A Savings Tool

Mental Peace

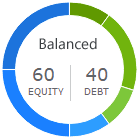

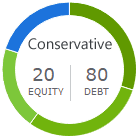

Mutual Fund Portfolios

Tailor made portfolios of mutual funds to help you achieve various investment goals, which can be further customized to suit your specific requirements.

Testimonials

AMITABH DEY

Developing strategies for Global Defence OEMs for market entry and JVs/SPVs with Indian Industry.

Star Rating

A highly professional and agile organisation with complete alignment of the market variables and investor requirements. Ritesh and Tejas believe in achieving customer delight and are available 24/7/365. My personal portfolio did not see red even in the toughest of times. Highly recommended for both short and long term portfolio structuring with absolutely no bias towards any instrument. Very deep and strong understanding of both Global and Indian financial markets..

Puthusseri John

Retired-Goverment

Star Rating

I know Ritesh since last two decades. He knows his subject well and gives right advice.

Enid Judith Dsouza

Freelance Writer | Lifestyle Blogger

Star Rating

The reason I have some savings in my account is due to Ritesh. Before I invested, he asked me to note down my expenses, match with my salary and realize what I could and couldn't save. Every time I need his guidance, he's always been around. Look no further for your investment requirements! My mom used to invest with their father and I was introduced to Ritesh once I began working. It's been great!

Ravi Samalad

Assistant Manager - Editoral for Morningstar.in

Star Rating

I have know Ritesh for over a decade now. He always keeps client interest first. His advice is unbiased, backed by his years of industry experience and research. Also, he has been at the forefront in adoption of technology to provide seamless experience to his clients. His clients vouch for it. He is constantly adapting himself to provide the best for his clients and honing his skills through continuous learning.

Pradip Soni

Self Employeed

Star Rating

Positive: Professionalism, Responsiveness Associated with this group since more than 20 years now. Never had any negative experience. always learnt something new about market, investments and many more things. Would always like to recommend to others.

Deepak Desai

Experienced Professional of Business Excellence Techniques (like WCM,TPM, TQM, Lean, 5S, Kaizen, Poka-Yoke etc..)

Star Rating

It's most reliable, extremely trustworthy, responsive & pertinent to the point advice for individual Financial Goals. Always available for help !

Jayesh Chafekar

Body Engineering at Bentley Motors Ltd. Company NameALLYGROW TECHNOLOGIES UK LIMITED

Star Rating

Financial management is certainly one of the important aspect in anyone's life and both Ritesh & Tejas are well-rounded when it comes to financial planning. It's been over 10 years I have known them and I can surely claim that they haven't let me down with their pristine financial knowledge and managed my portfolio perfectly. They are the advisors who can make you shine in good markets and in bad.

Sherwyn Lopes

DVP - IT Governance at RBL Bank

Star Rating

One of the most reliable investment advisors.

Sydney Miranda

Nri

Star Rating

DhanSaathi has been managing my portfolio since 2006. I had a very positive experience in terms of earnings but more than that i had a wonderful experience of learning on matters related to the various investment markets, the Indian and even the Global economy and other related matters affecting my portfolio. These learning experiences were either through Ritesh's informative emails or through the many conversations we had in his two offices in Mumbai. I am a NRI client and my visits to Mumbai were always very short and hectic but Ritesh was always available and found the time to accommodate my visits to his office on very short notice. Ritesh was always ready to do his best to meet expectations. I commend Ritesh and Tejas on the various accolades he and his consultancy have achieved over the years. I also commend them for embracing technology very early on and providing a interactive and user friendly platform on their website. Ritesh and his family are clearly very invested in the consultancy business and have a very high customer focus. I fully recommend their services.

Jaunita Dey

Teacher-At Raghubir Singh Junior Modern School (RSJMS) and Pathways School Noida

Star Rating

Financial management is certainly one of the important aspect in anyone's life and both Ritesh & Tejas are well-rounded when it comes to financial planning. It's been over 10 years I have known them and I can surely claim that they haven't let me down with their pristine financial knowledge and managed my portfolio perfectly. They are the advisors who can make you shine in good markets and in bad.

Vijay aidasani

Founder-AidasaniZ is one of the leading waterproofing Co. in Mumbai

Star Rating

DhanSaathi is like a family member to us.

Prasanna Pathak

Fund Manager

Star Rating

Known Ritesh and Tejas for the last 16 years. Has always given advise best suited to clients. Always there to help / support when needed regarding any documents/ filing etc. True partner in wealth creation.

Team

Hardworking, Committed, Dependable, Friendly and Knowledgeable Professional.

Deepak Sheth

Managing Director

Kalpana Sheth

Director

Ritesh Sheth

Director

Tejas Sheth

DirectorOur Clients

Insurance

Insurance is a means of protection from financial loss. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

Team Plan

Iprotect Term Policy

- Tax Benefits u/s 80C & 80D*T&C.

- 98.6% Claim Settlement Ratio.

- In-built Terminal Illness Benefit.

- 1 Day Claim Settlement.Covers All forms of Death.

Health Plan

BajajAllianz Health Guard

- Cashless Claim Settlement Within 60mins

- Extensive Coverage with many benefits.

- EMI Option Available.

- Long term policy discount.

Car Policy

Bajaj Allianz Car Insurance

- Quickest Settlement of claim within 20 mins only with Motor OTS.

- Protect your car against accidents, third party liability

- 4000+ Network Garage.

Frequently Asked Questions

Different investment avenues are available to investors. Mutual funds also offer good investment opportunities to the investors. Like all investments, they also carry certain risks. The investors should compare the risks and expected returns after adjustment of tax on various instruments while taking investment decisions. The investors may seek advice from experts while making investment decisions. With an objective to make the investors aware of functioning of mutual funds, an attempt has been made to provide information in question-answer format which may help the investors in taking investment decisions.

-

What is a Mutual Fund?

Mutual fund is a mechanism for pooling money by issuing units to the investors and investing funds in securities in accordance with objectives as disclosed in offer document. Investments in securities are spread across a wide cross-section of industries and sectors and thus the risk is diversifiedbecause all stocks may not move in the same direction in the same proportion at the same time. Mutual funds issue units to the investors in accordance with quantum of money invested by them. Investors of mutual funds are known as unitholders. The profits or losses are shared by investors in proportion to their investments. Mutual funds normally come out with a number of schemes which are launched from time to time with different investment objectives. A mutual fund is required to be registered with Securities and Exchange Board of India (SEBI) before it can collect funds from the public.

-

Feugiat scelerisque varius morbi enim nunc faucibus a pellentesque?

Dolor sit amet consectetur adipiscing elit pellentesque habitant morbi. Id interdum velit laoreet id donec ultrices. Fringilla phasellus faucibus scelerisque eleifend donec pretium. Est pellentesque elit ullamcorper dignissim. Mauris ultrices eros in cursus turpis massa tincidunt dui.

-

What is Net Asset Value (NAV) of a scheme?

The performance of a particular scheme of a mutual fund is denoted by Net Asset Value (NAV). Mutual funds invest the money collected from investors in securities markets. In simple words, NAV is the market value of the securities held by the scheme. Since market value of securities changes every day, NAV of a scheme also varies on day to day basis. The NAV per unit is the market value of securities of a scheme divided by the total number of units of the scheme on any particular date. For example, if the market value of securities of a mutual fund scheme is INR 200 lakh and the mutual fund has issued 10 lakh units of INR 10 each to the investors, then the NAV per unit of the fund is INR 20 (i.e.200 lakh/10 lakh). NAV is required to be disclosed by the mutual funds on a daily basis. The NAV per unit of all mutual fund schemes have to be updated on AMFI‟s website and the Mutual Funds‟ website by 9 p.m. of the same day. Fund of Funds are allowed time till 10 a.m. the following business day to update the information.

-

What are the different types of mutual fund schemes?

Schemes according to Maturity Period: A mutual fund scheme can be classified into open-ended scheme or close-ended scheme depending on its maturity period. Open-ended Fund/Scheme An open-ended fund or scheme is one that is available for subscription and repurchase on a continuous basis. These schemes do not have a fixed maturity period. Investors can conveniently buy and sell units at Net Asset Value (NAV) per unit which is declared on a daily basis. The key feature of open-end schemes is liquidity. Close-ended Fund/Scheme A close-ended fund or scheme has a stipulated maturity period e.g. 3-5 years. The fund is open for subscription only during a specified period at the time of launch of the scheme. Investors can invest in the scheme at the time of the new fund offer and thereafter they can buy or sell the units of the scheme on the stock exchanges where the units are listed. In order to provide an exit route to the investors, some close-ended funds give an option of selling back the units to the mutual fund through periodic repurchase at NAV related prices. SEBI Regulations stipulate that at least one of the two exit routes is provided to the investor i.e. either repurchase facility or through listing on stock exchanges. Schemes according to Investment Objective: A scheme can also be classified as growth scheme, income scheme or balanced scheme considering its investment objective. Such schemes may be open-ended or close-ended schemes as described earlier. Such schemes may be classified mainly as follows: Growth/Equity Oriented Scheme The aim of growth funds is to provide capital appreciation over the medium to long- term. Such schemes normally invest a major part of their corpus in equities. Such funds have comparatively high risks. These schemes provide different options to the investors like dividend option, growth, etc. and the investors may choose an option depending on their preferences. The investors must indicate the option in the application form. The mutual funds also allow the investors to change the options at a later date. Growth schemes are good for investors having a long-term outlook seeking appreciation over a period of time. Income/Debt Oriented Scheme The aim of income funds is to provide regular and steady income to investors. Such schemes generally invest in fixed income securities such as bonds, corporate debentures, Government securities and money market instruments. Such funds are less risky compared to equity schemes. However, opportunities of capital appreciation are also limited in such funds. The NAVs of such funds are affected because of change in interest rates in the country. If the interest rates fall, NAVs of such funds are likely to increase in the short run and vice versa. However, long term investors may not bother about these fluctuations. Balanced/Hybrid Scheme The aim of balanced schemes is to provide both growth and regular income as such schemes invest both in equities and fixed income securities in the proportion indicated in their offer documents. These are appropriate for investors looking for moderate growth. They generally invest 40-60% in equity and debt instruments. These funds are also affected because of fluctuations in share prices in the stock markets. However, NAVs of such funds are likely to be less volatile compared to pure equity funds. Money Market or Liquid Schemes These schemes are also income schemes and their aim is to provide easy liquidity, preservation of capital and moderate income. These schemes invest exclusively in short-term instruments such as treasury bills, certificates of deposit, commercial paper and inter-bank call money, government securities, etc. Returns on these schemes fluctuate much less compared with other funds. These funds are appropriate for corporate and individual investors as a means to park their surplus funds for short periods. Gilt Funds These funds invest exclusively in government securities. Government securities have no default risk. NAVs of these schemes also fluctuate due to change in interest rates and other economic factors as is the case with income or debt oriented schemes. Index Funds Index Funds replicate the portfolio of a particular index such as the BSE Sensitive index (Sensex), NSE 50 index (Nifty), etc. These schemes invest in the securities in the same weightage comprising of an index. NAVs of such schemes would rise or fall in accordance with the rise or fall in the index, though not exactly by the same percentage due to some factors known as “tracking error” in technical terms. Necessary disclosures in this regard are made in the offer document of the mutual fund scheme.

-

What is a General Insurance?

A policy or agreement between the policyholder and the insurer which is considered only after realization of the premium. The premium is paid by the insurer who has a financial interest in the asset covered. The insurer will protect the insured from the financial liability in case of loss.

-

What is a life Insurance?

A life insurance policy is a contract with an insurance company. In exchange for premium payments, the insurance company provides a lump-sum payment, known as a death benefit, to beneficiaries upon the insured's death. Typically, life insurance is chosen based on the needs and goals of the owner. Term life insurance generally provides protection for a set period of time, while permanent insurance, such as whole and universal life, provides lifetime coverage. It's important to note that death benefits from all types of life insurance are generally income tax-free.